40+ Post office compound interest calculator

Calculating post office FD interest payout is pretty simple. Maturity Value Principal 1.

Mf Vob8fj73urm

A base value needs to have an amount of 05 added each month for x number of months.

. 110 10 1. The following is a basic example of how interest works. Here is a online FD interest calculator which gives maturity amount and interest.

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. The post office PPF calculator estimates the following based on the above inputs. The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100.

Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Interest depends on various factors and this is one of those. M R x 1 n x n 1 1- 1 i -13 In the above formula.

Banks and other financial institutions. This calculator helps you calculate the wealth gain and expected returns for your monthly SIP investment. RD interest rate varies across all the tenure options.

You get a rough estimate on the maturity amount for any monthly SIP based on a. How much money will 40 be worth if you let the interest grow. Thus the interest of the second year would come out to.

Amount Interest Rate Years to Invest. The current post office PPF interest rate is 71 for FY 2022-23. There are two distinct methods of accumulating interest categorized into simple interest or compound interest.

Age of the Applicant. The formula used to calculate returns on a recurring deposit is. R is the amount deposited per month.

I will need to subtract a date. Open post office RD interest rate calculator on your. 40 Compound Interest Calculator.

After investing for 10 years at 5 interest. Using INDmoney post office RD interest rate 2022 calculator is easy and can be done only in a couple of simple steps. To begin your calculation take your daily interest rate and add 1 to it.

Want to know how much you can earn interest on specific amount on FD - Fixed Deposit in Bank or Post Office. All you have to do is use the compound interest formula given below for all the required details. Next raise that figure to the power of the number of days it will be compounded for.

N is the number of. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month.

My Amex Gold Card Is My Go To For Food Spending Because Of Its Rewards

Cognitus Announces Its Partnership With Icertis The Leader In Contract Lifecyclye Management

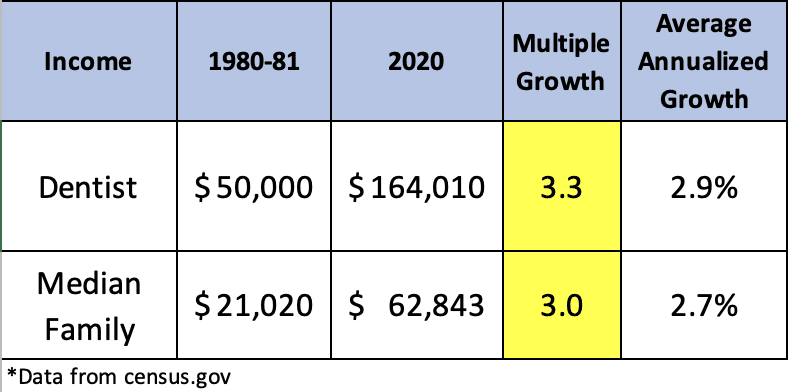

How Dental School Costs Have Changed Over 40 Years Student Loan Planner

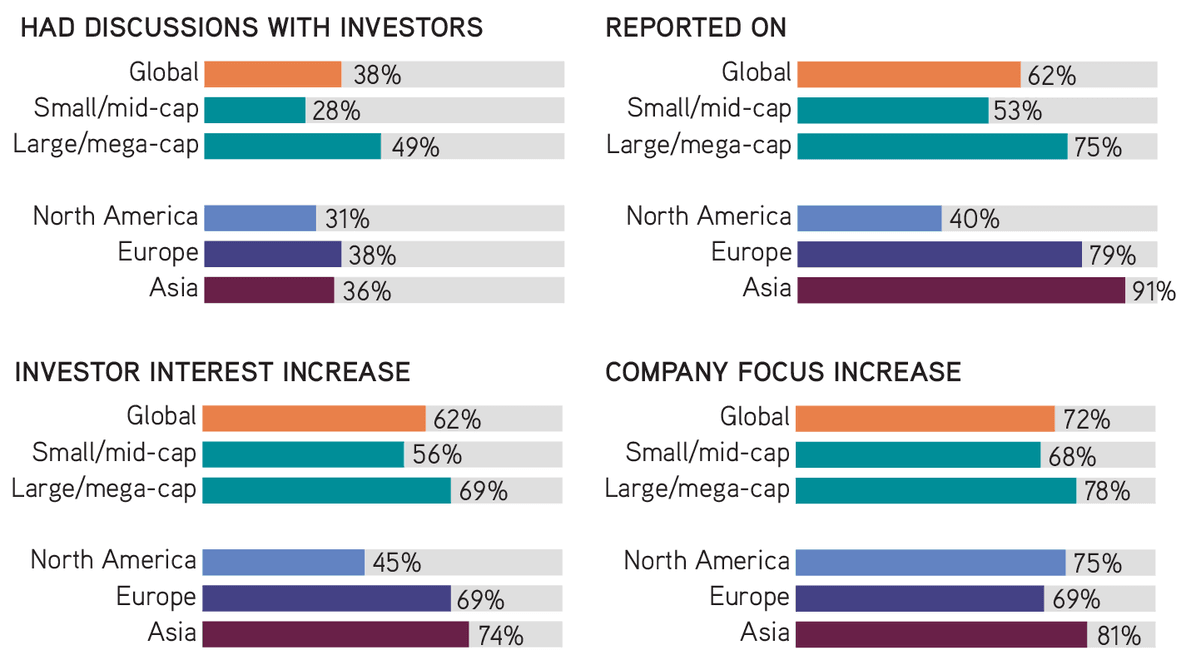

Ir Magazine Fall 2021

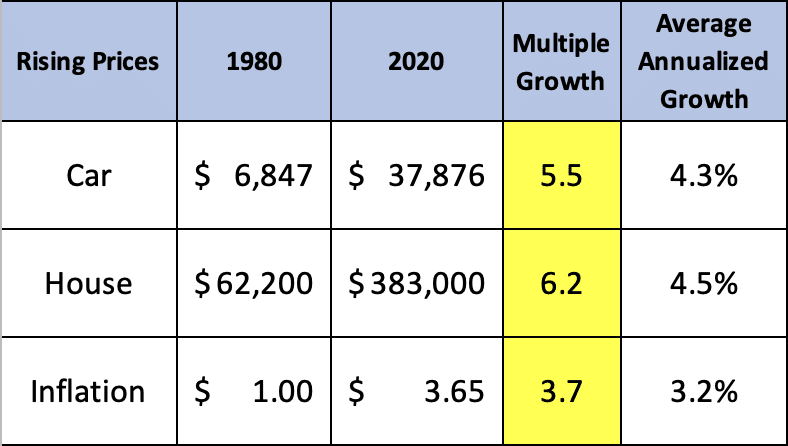

How To Invest When You Re Beginning After 40 Keep Investing Imple Tupid

Pin On Report Templates

Dc Abstract Entities Hand Green Lantern The Secret Origin Of The Guardians V2 40 Dc Hugh Fox Iii

General Fi Archives Managing Fi

Ir Magazine Fall 2021

My Little Pony Equestria Girls Fashion Squad Rainbow Dash Sunset Shimmer Mini Doll Set With 40 Accessories Newegg Com

Chattanooga Does Your Homes Roof Need To Be Replaced

How To Retire At 40 Quora

62 67 Acres White City Or Property Id 9412972 Land And Farm

Effective Annual Rate Formula Calculator Examples Excel Template

How Dental School Costs Have Changed Over 40 Years Student Loan Planner

890 Mountain Home Road Woodside Ca 94062 Compass

A 2022 Update On The Returns Of My Many Real Estate Investments Physician On Fire